History Of Machine Learning In Finance

Wed like to point out that reinforcement learning is a relatively new practical field of AI in finance with a long history of theoretical discoveries but a small period of real-world implementations 21. Machine Learning in Finance provides the most comprehensive collection of machine learning research for financial applications and offers personalized machine.

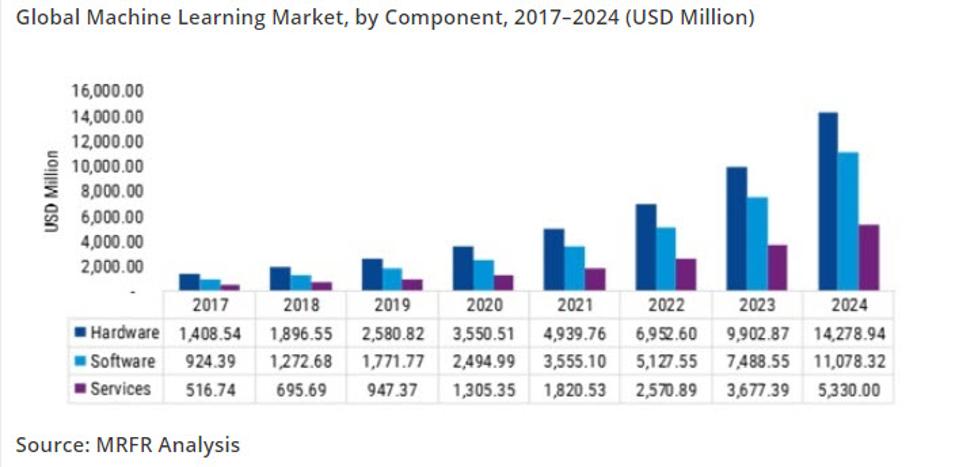

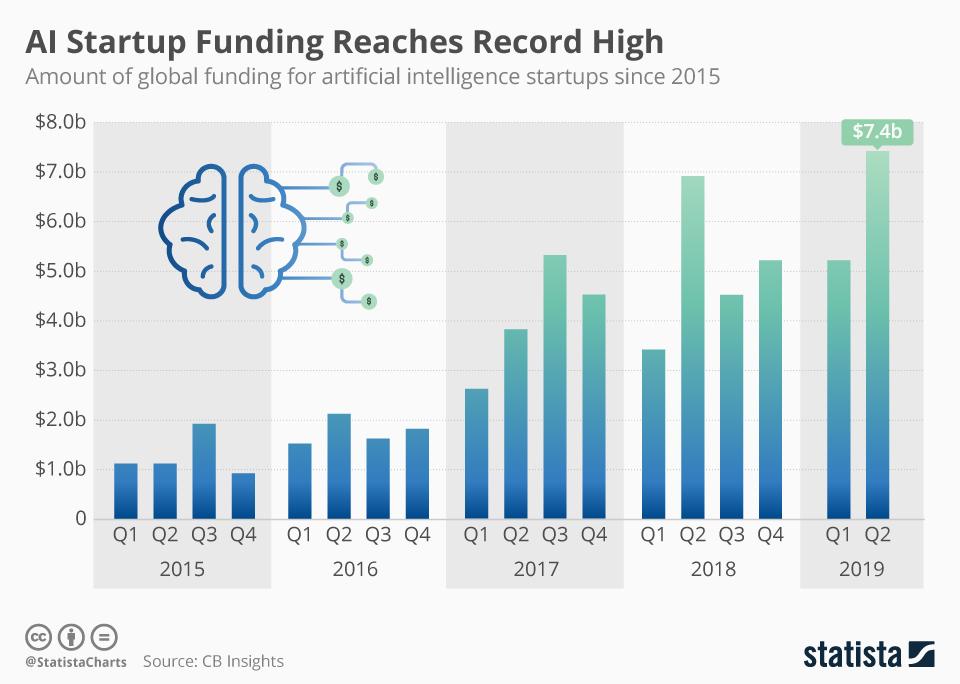

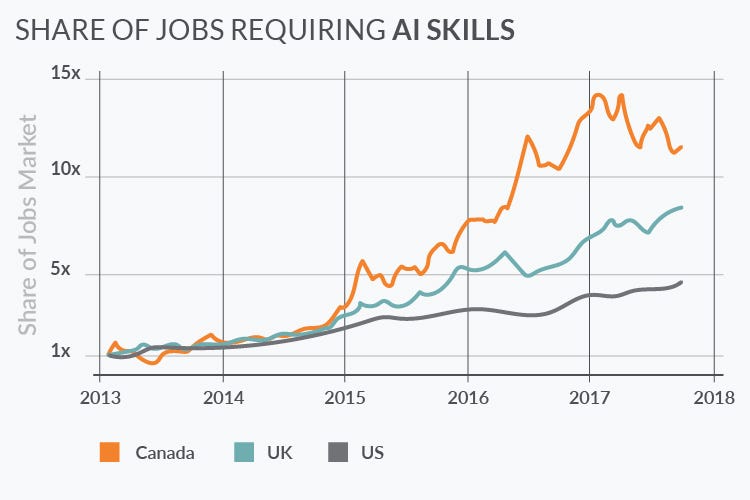

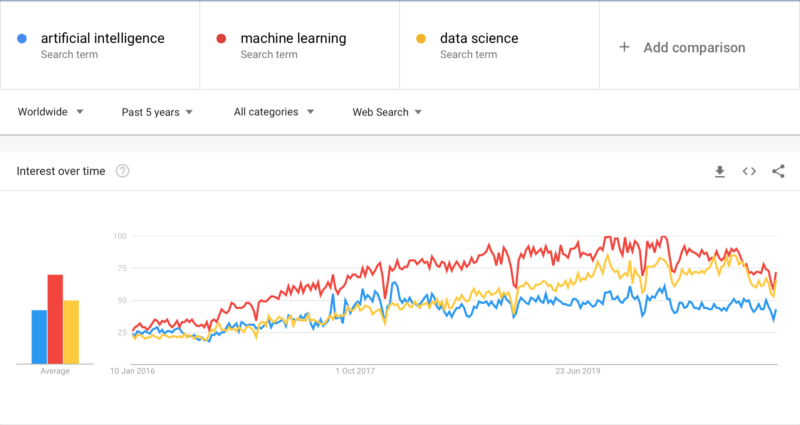

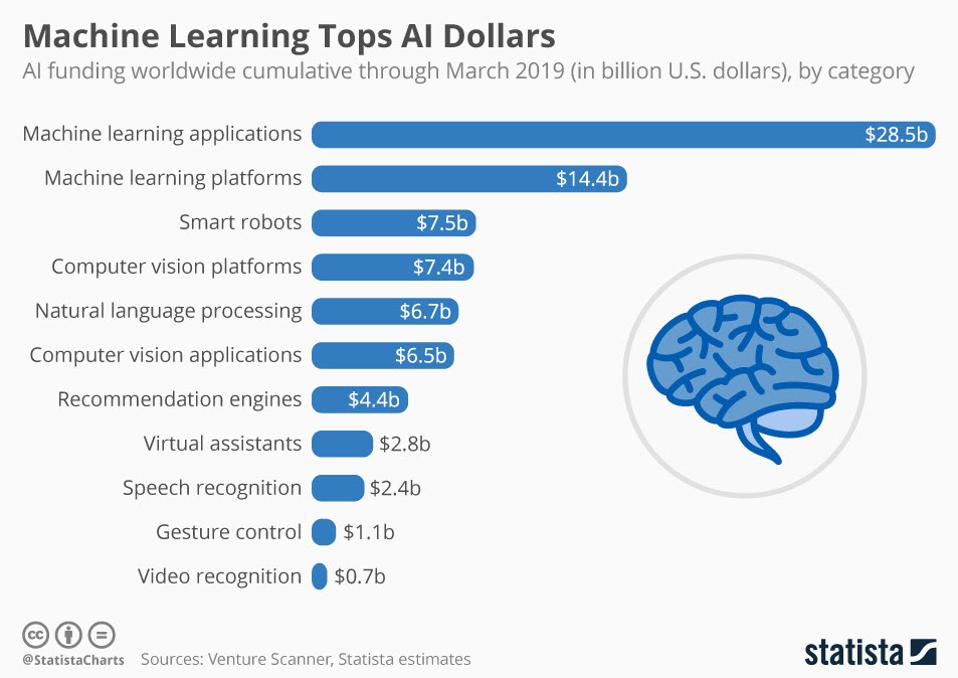

Roundup Of Machine Learning Forecasts And Market Estimates 2020

Machine Learning in Finance.

History of machine learning in finance. Lenders use the credit score to assess a prospective. The essential difference from other machine learning domains is the approach to. It is an underwriting solution that helps with credit assessment.

The use of mathematics in the service of social and economic analysis dates back to the 17th century. The first presents supervised learning for cross-sectional. Arthur Samuel first came up with the phrase Machine Learning in 1952.

Nevertheless the researchers and practitioners in these respective domains have been essential in laying the bedrock of what we now refer to as machine learning. Derek Snow in this piece. Fundamentals of Machine Learning in Finance will provide more at-depth view of supervised unsupervised and reinforcement learning and end up in a project on using unsupervised learning.

Much of AI in the 1950s and 1960s did not focus on finance applications. Neural networks which would become a cornerstone of deep learning were developed in the 1960s and grew rapidly. From Theory to Practice is divided into three parts each part covering theory and applications.

Machine learning in finance is now considered a key aspect of several financial services and applications including managing assets evaluating levels of risk calculating credit scores. In what Samuel called rote learning his program recordedremembered all positions it had already seen and combined this with the values of the reward function. Based on a variety of data points this platform provides an impressive level of transparency.

Artificial Intelligence here makes it possible to assess borrowers that lack a credit history. Los Angeles-based ZestFinance introduced the Zest Automated Machine Learning ZAML platform. In the 1960s a substantial body of work on Bayesian statistics was being developed that would later be used in ML.

A learner with some or no previous knowledge of Machine Learning ML will get to know main algorithms of Supervised and Unsupervised Learning and Reinforcement Learning and will be able to use ML open source Python packages to design test and implement ML algorithms in Finance. The program was the game of checkers and the IBM computer improved at the game the more it played studying which moves made up. This book is written for advanced graduate students and academics in financial econometrics mathematical finance and applied statistics in addition to quants and data scientists in the field of quantitative finance.

Samuel also designed a number of mechanisms allowing his program to become better. Credit Score A credit score is a number representative of an individuals financial and credit standing and ability to obtain financial assistance from lenders. Based on a variety of data points this platform provides an impressive level of transparency.

Los Angeles-based ZestFinance introduced the Zest Automated Machine Learning ZAML platform. Finance and Economics have been slow to adopt modern machine learning techniques. 1952 Arthur Samuel wrote the first computer learning program.

Artificial Intelligence here makes it possible to assess borrowers that lack a credit history. It is an underwriting solution that helps with credit assessment.

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

Roundup Of Machine Learning Forecasts And Market Estimates 2020

Roundup Of Machine Learning Forecasts And Market Estimates 2020

Machine Learning In Finance From Theory To Practice Matthew F Dixon Springer

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

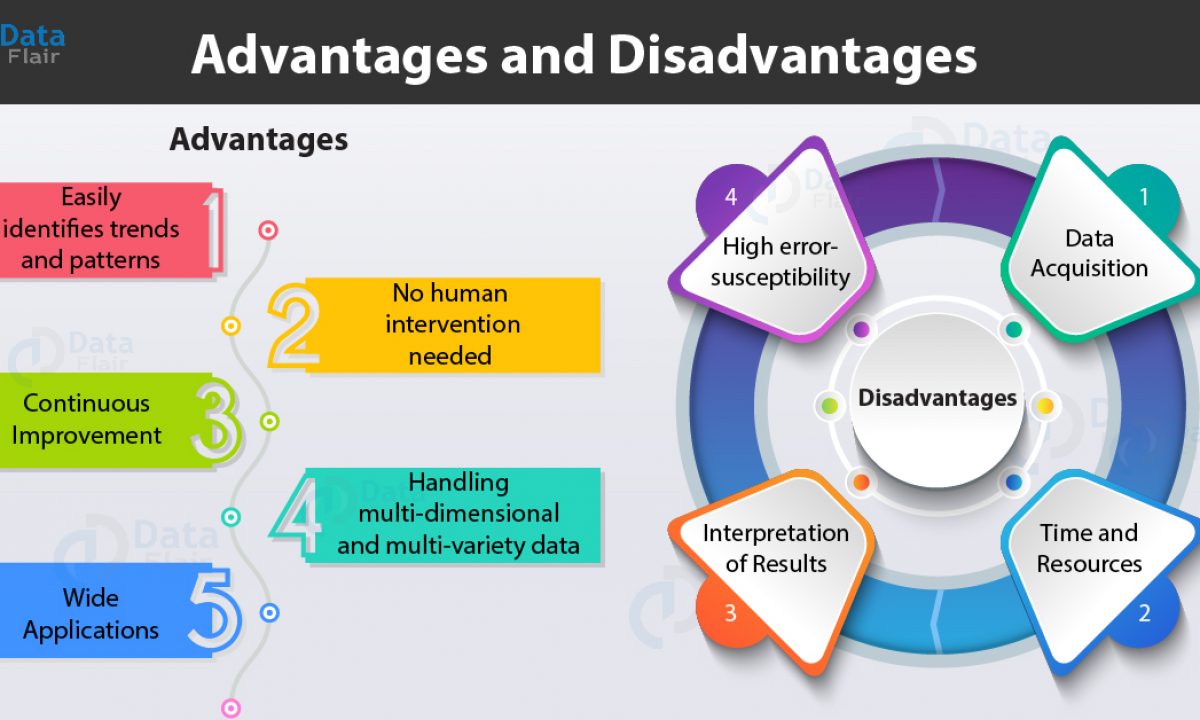

Advantages And Disadvantages Of Machine Learning Language Dataflair

How To Apply Machine Learning In Demand Forecasting For Retail Mobidev

Machine Learning In Finance Overview Applications

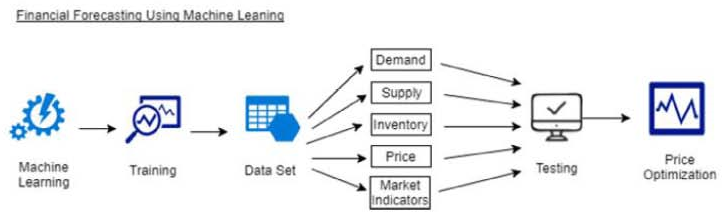

Financial Forecasting Using Machine Learning Linh Truong

Roundup Of Machine Learning Forecasts And Market Estimates 2020

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

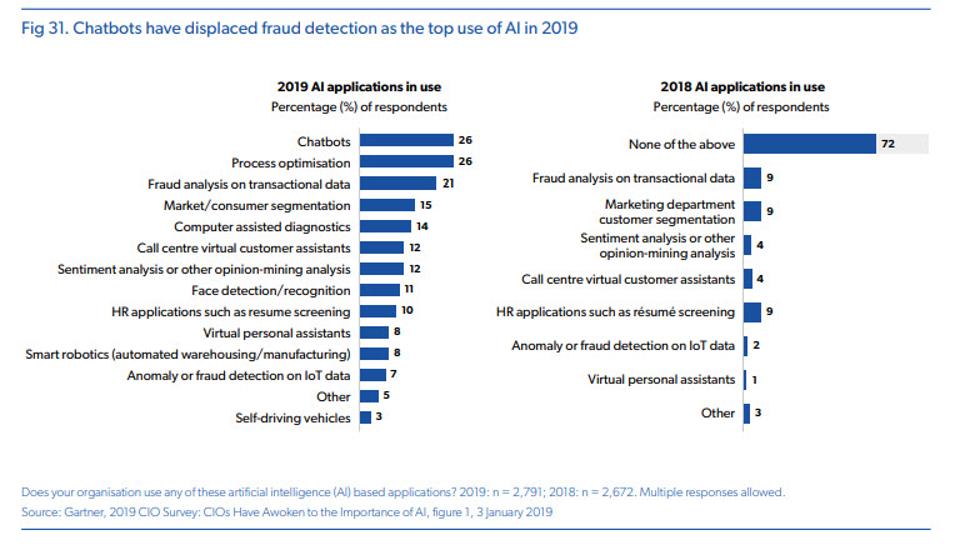

100 Ai Use Cases Applications In 2021 In Depth Guide

Artificial Intelligence In Banking 2021 How Banks Use Ai

Ai In Finance 2021 Applications Benefits In Financial Services

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

Machine Learning In Finance Why What How By Konstantin Didur Towards Data Science

Financial Forecasting Using Machine Learning Linh Truong

Roundup Of Machine Learning Forecasts And Market Estimates 2020

Post a Comment for "History Of Machine Learning In Finance"